Free payroll calculator 2020

Free Unbiased Reviews Top Picks. Checkmark is one of the most popular free payroll tax calculators currently.

Paycheck Calculator Online For Per Pay Period Create W 4

Small Business Low-Priced Payroll Service.

. Payroll management made easy. Then multiply that number by the total number of weeks in a year 52. Ad Leverage the Power of HR Talent Payroll and Time in a Single Unified Solution.

Ad Compare This Years Top 5 Free Payroll Software. Compare the top bookkeeping software options. Ad Compare This Years Top 5 Free Payroll Software.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and. Starting as Low as 6Month. Use the Free Paycheck Calculators for any gross-to-net calculation need.

Starting as Low as 6Month. Median household income in. Ad Bookkeeping for small business.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Free Unbiased Reviews Top Picks. It will confirm the deductions you include on your.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. For example if an employee makes 25 per hour and. 3 Months Free Trial.

Perfect for personal or small business use. App Development Customer Data Platform Tax Debt Relief. Intelligent user-friendly solutions to the never-ending realm of what-if scenarios.

Rules for calculating payroll taxes. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions. Multiply the hourly wage by the number of hours worked per week.

Small Business Low-Priced Payroll Service. Ad Looking for best payroll software. Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Enter your info to see your take home pay. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Computes federal and state tax withholding for. Content updated daily for best payroll software. It is unclear what degree of international payroll functionality is available.

3 Months Free Trial. These free payroll calculators make it easy to figure out final pay gross-up pay PPP Forgiveness bonuses tips 401k and local taxes for all 50 states and the District of Columbia. Find out how easy it is to manage your payroll today.

The maximum an employee will pay in 2022 is 911400. Designed For Smaller Teams UKG Ready Helps You Increase Efficiency Simplify Compliance. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Heres a step-by-step guide to walk you through. Simple and easy software options.

10 Best Free Payroll Calculator In India Fy 2021 22 Paycheck Calculator

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Paycheck Calculator Take Home Pay Calculator

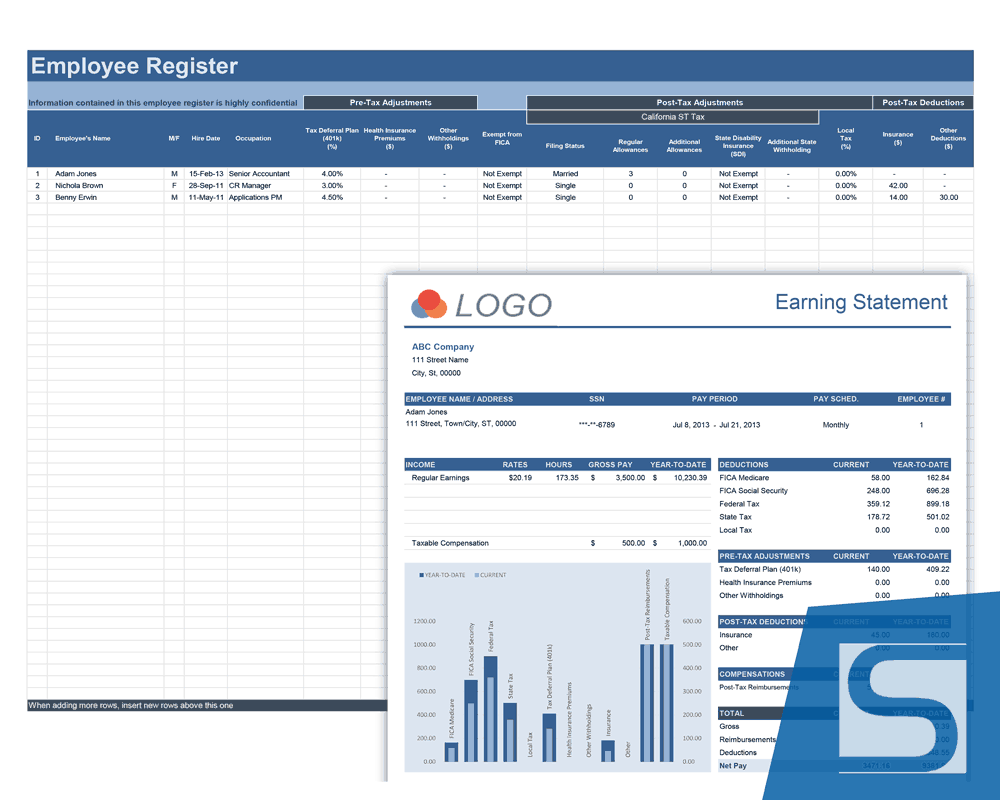

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Payroll Taxes For Your Small Business

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Payroll Calculator Free Employee Payroll Template For Excel

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator Free Employee Payroll Template For Excel

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Hourly Paycheck Calculator Step By Step With Examples

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Payroll Calculator Free Employee Payroll Template For Excel